Navigating the Market for Affordable Housing: A Comprehensive Guide

Related Articles: Navigating the Market for Affordable Housing: A Comprehensive Guide

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Market for Affordable Housing: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Market for Affordable Housing: A Comprehensive Guide

The pursuit of homeownership is a universal aspiration, but the rising cost of housing presents a significant challenge for many. In an increasingly competitive market, finding a home that aligns with both financial realities and personal needs can feel daunting. However, there are strategies and resources available to help individuals navigate this complex landscape, particularly when seeking more affordable housing options. This guide provides a comprehensive overview of factors to consider, strategies to employ, and resources to utilize when embarking on the journey of finding a home within a specific budget.

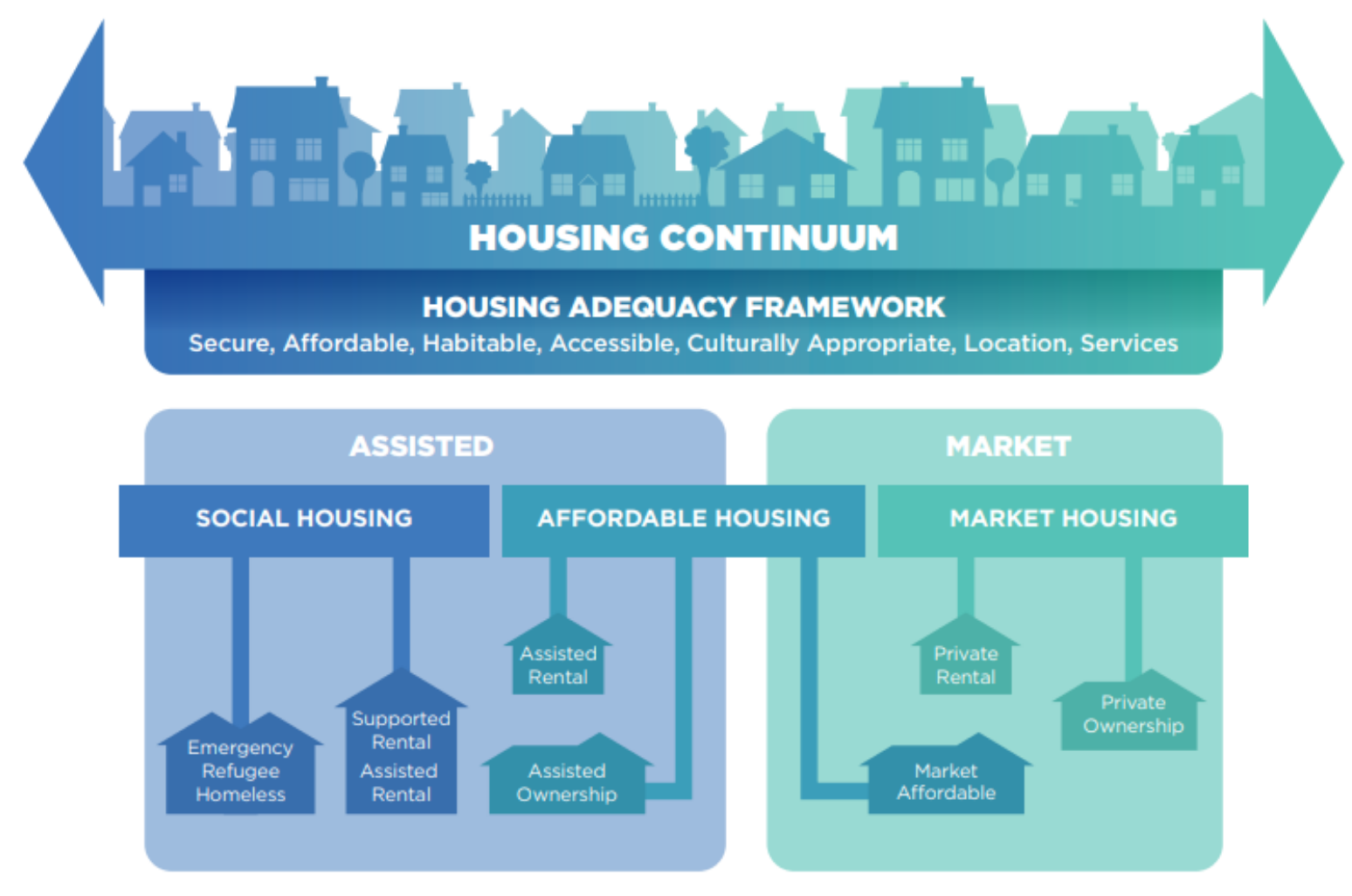

Understanding the Dynamics of Affordable Housing

The term "affordable housing" encompasses a broad range of properties, from modest starter homes to renovated units in established neighborhoods. The key defining factor is the price point, which is generally considered to be below the median home price in a given area. This affordability can be achieved through various means, including:

- Location: Homes in rural areas or smaller towns often have lower price tags than those in bustling urban centers.

- Property Type: Condominiums, townhouses, or even single-family homes with smaller footprints can be more affordable than larger, detached houses.

- Condition: Homes requiring renovations or updates may be priced lower than those in pristine condition.

- Market Conditions: Economic fluctuations, interest rates, and local housing inventory can influence price trends.

The Importance of Defining Your Needs and Budget

Before embarking on the search for a home, it is crucial to establish a clear understanding of your individual needs and financial constraints. This involves:

- Identifying Essential Features: Determine the key features you cannot compromise on, such as the number of bedrooms, bathrooms, or proximity to amenities.

- Establishing a Realistic Budget: Assess your financial capacity, including your income, savings, and potential mortgage payments. It is crucial to factor in not only the purchase price but also ongoing costs like property taxes, insurance, and maintenance.

- Exploring Funding Options: Research different mortgage programs, down payment assistance programs, and other financial aid options that can make homeownership more accessible.

Strategies for Finding Affordable Housing

1. Leverage Online Resources:

- Real Estate Websites: Utilize popular websites like Zillow, Realtor.com, Redfin, and Trulia to filter listings by price, location, and other criteria.

- Local MLS Listings: Connect with local real estate agents to access Multiple Listing Services (MLS) for a broader selection of available properties.

- Government Housing Programs: Explore websites like HUD.gov and USDA.gov for information on government-backed housing programs and subsidies.

2. Partner with a Real Estate Agent:

- Expert Guidance: A knowledgeable real estate agent can provide valuable insights into the local market, negotiate purchase agreements, and guide you through the complexities of the homebuying process.

- Access to Exclusive Listings: Agents often have access to properties that are not yet publicly listed, potentially giving you a competitive edge.

- Negotiation Skills: An experienced agent can leverage their expertise to negotiate the best possible price and terms on your behalf.

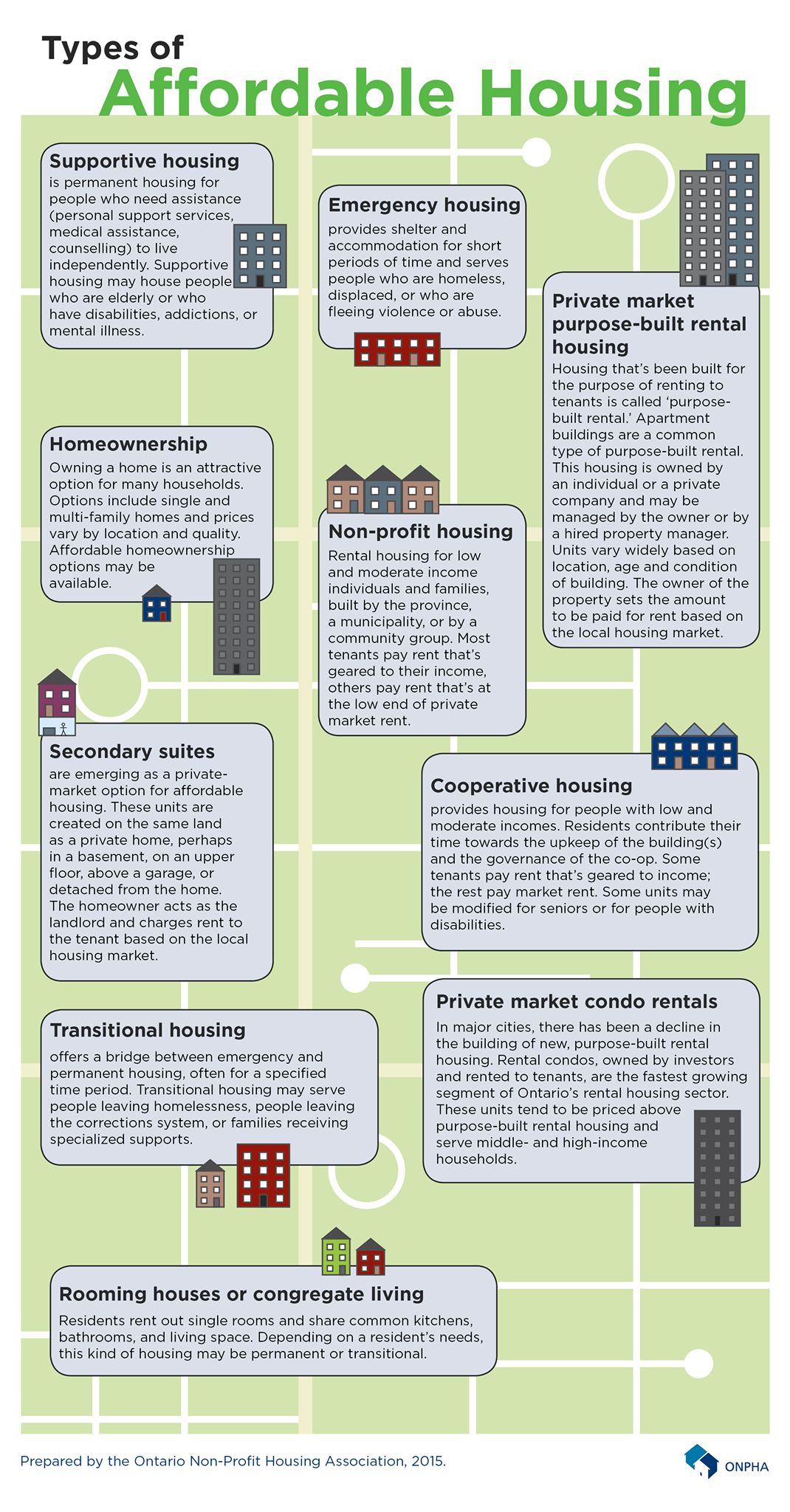

3. Consider Alternative Housing Options:

- Condominiums and Townhouses: These options can offer a more affordable entry point to homeownership, with shared amenities and lower maintenance responsibilities.

- Fixer-Uppers: Homes requiring renovations may be priced lower than move-in ready properties, allowing you to invest in improvements over time.

- Rent-to-Own Programs: These programs provide an opportunity to gradually build equity while renting, potentially leading to eventual ownership.

4. Expand Your Search Area:

- Explore Suburbs and Rural Areas: Homes in less densely populated areas often have lower prices than those in urban centers.

- Consider Up-and-Coming Neighborhoods: Areas undergoing revitalization or gentrification may offer opportunities for affordable homeownership before prices rise.

5. Be Prepared to Negotiate:

- Research Comparable Properties: Gather data on similar homes in the area to establish a fair market value.

- Offer a Competitive Price: Be prepared to negotiate a price that reflects the property’s condition, market trends, and your budget.

- Seek Seller Concessions: Request concessions such as closing costs, repairs, or credits to offset the purchase price.

6. Explore Financial Assistance Programs:

- Down Payment Assistance: Many government agencies and non-profit organizations offer programs to assist with down payment costs.

- Mortgage Programs: Explore government-backed loans like FHA loans, VA loans, and USDA loans, which often have more flexible eligibility requirements and lower down payment requirements.

- Community Development Programs: Local organizations may offer affordable housing programs tailored to specific needs and income levels.

FAQs about Affordable Housing

1. What are the typical down payment requirements for affordable homes?

Down payment requirements vary depending on the mortgage program and lender. Government-backed loans like FHA loans may have lower down payment requirements, while conventional loans generally require a larger down payment. Down payment assistance programs can help offset these costs.

2. How can I improve my credit score to qualify for a mortgage?

Improving your credit score requires paying bills on time, reducing credit card debt, and avoiding new credit applications. Regularly checking your credit report for errors and disputing any inaccuracies can also contribute to a higher score.

3. What are the common hidden costs associated with homeownership?

Beyond the mortgage payment, homeowners should factor in ongoing expenses like property taxes, homeowner’s insurance, maintenance costs, utilities, and potential HOA fees.

4. How can I find resources and support for affordable housing?

Local housing authorities, non-profit organizations, and government agencies offer a variety of resources and support programs for affordable housing. Contact your local community development agency or visit online resources like HUD.gov for information.

5. What are some tips for finding a good real estate agent?

Seek an agent with experience in the local market, a strong track record of successful transactions, and a reputation for honesty and integrity. Ask for referrals from friends, family, or colleagues and interview multiple agents before making a decision.

Tips for Finding Affordable Housing

- Be patient and persistent: The search for affordable housing can be time-consuming, so be prepared for a lengthy process.

- Don’t settle for the first option: Explore multiple options and compare properties carefully before making a decision.

- Get pre-approved for a mortgage: This demonstrates your financial readiness to lenders and gives you a clearer understanding of your borrowing capacity.

- Be prepared to compromise: You may need to adjust your expectations regarding location, size, or condition to find a home within your budget.

- Network and seek advice: Talk to friends, family, and colleagues who have recently purchased homes for insights and recommendations.

Conclusion

Finding affordable housing in a competitive market requires a strategic approach, informed decision-making, and a willingness to explore various options. By understanding your needs and budget, leveraging available resources, and employing effective strategies, individuals can navigate the complexities of the housing market and achieve the dream of homeownership. Remember that the journey may be challenging, but with persistence and the right guidance, finding a suitable and affordable home is achievable.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Market for Affordable Housing: A Comprehensive Guide. We appreciate your attention to our article. See you in our next article!