Navigating the Home Depot Credit Card: A Comprehensive Guide

Related Articles: Navigating the Home Depot Credit Card: A Comprehensive Guide

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Home Depot Credit Card: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Home Depot Credit Card: A Comprehensive Guide

The Home Depot Credit Card, a staple for many DIY enthusiasts and home improvement aficionados, provides a unique blend of convenience, rewards, and financing options. This guide delves into the intricacies of this popular card, exploring its features, benefits, and considerations for potential cardholders.

Understanding the Home Depot Credit Card:

The Home Depot Credit Card, issued by Synchrony Bank, is a store credit card specifically designed for purchases at The Home Depot. Its primary function is to simplify and enhance the shopping experience for customers seeking home improvement supplies, tools, and related products.

Key Features and Benefits:

- Exclusive Discounts and Promotions: Cardholders often receive access to exclusive discounts and promotions, including special offers on select products, seasonal sales, and early access to new merchandise. These discounts can significantly reduce the overall cost of home improvement projects.

- Flexible Financing Options: The card offers flexible financing options, allowing customers to spread out the cost of large purchases over time. This can be particularly helpful for major projects that require substantial upfront investment.

- Reward Points and Cash Back: The Home Depot Credit Card typically offers a rewards program that allows cardholders to earn points or cash back on eligible purchases. These rewards can be redeemed for future purchases at The Home Depot, providing further value and savings.

- Convenient Payment Methods: Cardholders can utilize the Home Depot Credit Card for online purchases, in-store transactions, and even for phone orders. This versatility simplifies the payment process and streamlines the overall shopping experience.

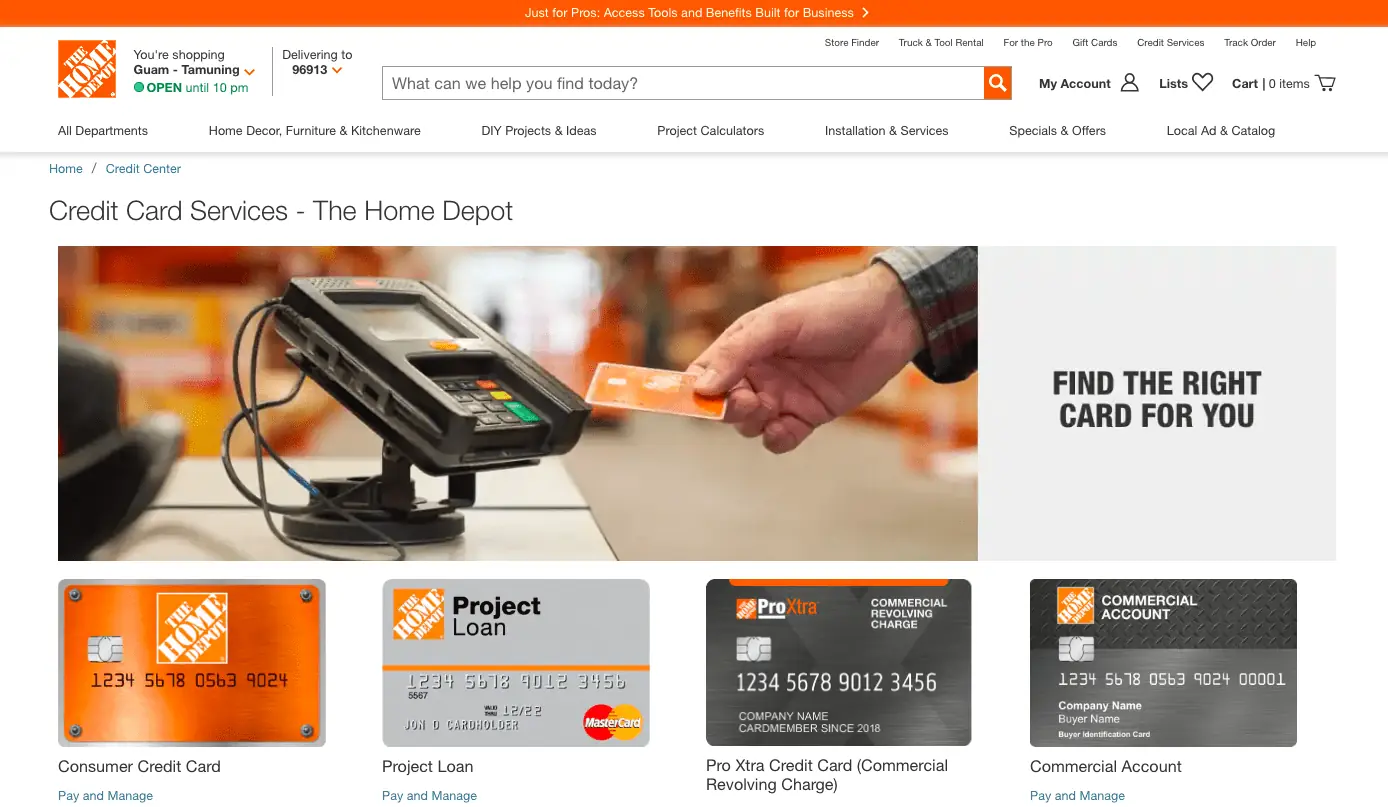

Types of Home Depot Credit Cards:

The Home Depot offers two primary credit card options:

- The Home Depot Credit Card: This is the standard card offering the aforementioned benefits. It often features a lower annual percentage rate (APR) for purchases made at The Home Depot.

- The Home Depot Consumer Credit Card: This card provides a more traditional credit card experience with a broader range of purchase options, including non-Home Depot purchases. However, it may have a higher APR compared to the standard Home Depot Credit Card.

Eligibility and Application Process:

To apply for a Home Depot Credit Card, applicants must meet certain eligibility criteria, which typically include:

- Minimum Age: Applicants must be at least 18 years old.

- Credit History: A good credit history is generally required, although applicants with limited credit history may be considered.

- Income: Proof of income may be requested to demonstrate financial stability.

The application process is straightforward and can be completed online, in-store, or over the phone. Applicants will need to provide personal information, including their Social Security number, address, and income details.

Important Considerations:

While the Home Depot Credit Card offers numerous benefits, it’s essential to consider the following factors:

- APR and Interest Charges: If balances are carried over, interest charges can accumulate rapidly. It’s crucial to understand the APR associated with the card and make timely payments to avoid excessive interest costs.

- Fees: The card may have annual fees, late payment fees, and other associated charges. It’s important to review the terms and conditions carefully to understand all applicable fees.

- Credit Limit: The credit limit assigned to a cardholder can influence their purchasing power. It’s wise to use credit responsibly and avoid exceeding the credit limit, as this can negatively impact credit scores.

FAQs about the Home Depot Credit Card:

1. What are the credit card’s APRs?

The APRs for the Home Depot Credit Card vary depending on the card type and the applicant’s creditworthiness. It’s recommended to review the card’s terms and conditions for specific APR details.

2. How do I make payments?

Payments can be made online, by phone, by mail, or in person at any Home Depot store.

3. Can I use the Home Depot Credit Card for purchases outside of The Home Depot?

The standard Home Depot Credit Card is primarily for purchases at The Home Depot, while the Consumer Credit Card can be used for purchases at other retailers.

4. What are the benefits of the rewards program?

The rewards program typically offers points or cash back on eligible purchases, which can be redeemed for future purchases at The Home Depot.

5. How do I check my account balance?

You can check your account balance online, through the mobile app, or by calling customer service.

Tips for Using the Home Depot Credit Card Wisely:

- Budgeting: Create a budget and stick to it to ensure responsible spending and prevent overspending.

- Timely Payments: Pay your balance in full each month to avoid interest charges and maintain a good credit score.

- Monitoring Spending: Regularly review your account statements to track your spending and identify any unauthorized charges.

- Utilizing Rewards: Take advantage of the rewards program and redeem points or cash back for future purchases.

- Customer Service: Contact customer service if you have any questions or concerns regarding your account.

Conclusion:

The Home Depot Credit Card offers a convenient and rewarding experience for home improvement enthusiasts. By understanding its features, benefits, and considerations, potential cardholders can make an informed decision about whether this card aligns with their financial needs and spending habits. Remember, responsible credit card use is key to maximizing the benefits and minimizing the risks associated with any credit card.

![Home Depot Credit Card Review 2023 [Login and Payment]](https://worldofcreditcards.com/wp-content/uploads/2020/03/Home-Depot-Credit-Card-3.jpg)

![The Home Depot Credit Cards Reviewed - Worth It? [2024]](https://upgradedpoints.com/wp-content/uploads/2020/07/The-Home-Depot-personal-credit-cards.jpg?auto=webpu0026disable=upscaleu0026width=1200)

Closure

Thus, we hope this article has provided valuable insights into Navigating the Home Depot Credit Card: A Comprehensive Guide. We hope you find this article informative and beneficial. See you in our next article!