Navigating Home Insurance: Understanding Payment Plans and Their Benefits

Related Articles: Navigating Home Insurance: Understanding Payment Plans and Their Benefits

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating Home Insurance: Understanding Payment Plans and Their Benefits. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating Home Insurance: Understanding Payment Plans and Their Benefits

Home insurance is a vital financial safety net, protecting homeowners from unexpected events such as fire, theft, or natural disasters. However, the cost of this essential coverage can be a significant financial burden, especially for those on a tight budget. Fortunately, many insurance providers offer flexible payment options, including installment plans, allowing homeowners to spread the cost of their premiums over time. This article delves into the intricacies of home insurance installment plans, highlighting their advantages, considerations, and potential challenges.

Understanding Home Insurance Installment Plans

Home insurance installment plans are payment arrangements that allow policyholders to divide their annual premium into smaller, more manageable monthly, quarterly, or semi-annual installments. This approach provides a structured payment schedule, easing the financial strain of paying a lump sum upfront.

Benefits of Home Insurance Installment Plans

- Improved Affordability: By breaking down the premium into smaller payments, installment plans make home insurance more accessible to individuals with limited financial resources. This ensures that homeowners can afford adequate coverage without jeopardizing their overall financial stability.

- Enhanced Cash Flow Management: Spreading premium payments over time improves cash flow management, allowing homeowners to allocate their funds more effectively and avoid unexpected financial strain.

- Predictability and Budgeting: Installment plans provide a predictable payment schedule, making it easier for homeowners to budget for their insurance costs and avoid surprises.

- Flexibility and Convenience: Many insurance providers offer various installment plan options, allowing homeowners to choose a payment frequency that aligns with their financial preferences and circumstances.

Considerations and Potential Challenges

While installment plans offer significant advantages, certain factors require consideration:

- Interest Charges: Some insurance providers may charge interest on installment plans, which can increase the overall cost of the insurance policy. It is crucial to inquire about any potential interest charges and compare them across different providers.

- Late Payment Fees: Late payments on installment plans can incur fees, impacting the affordability of the plan. It is essential to establish a payment reminder system and prioritize timely payments to avoid these penalties.

- Credit Score Impact: Some insurance providers may perform credit checks when offering installment plans. If a homeowner has a poor credit history, they might be subjected to higher interest rates or denied the installment option altogether.

- Limited Availability: Not all insurance providers offer installment plans, and the availability of such options may vary depending on the policy type and insurer.

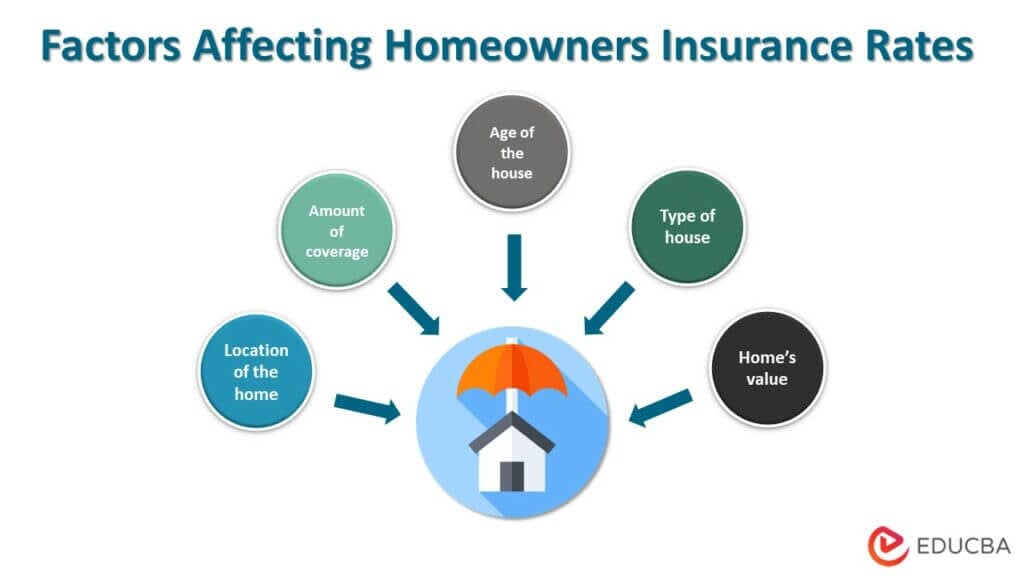

Factors Influencing Installment Plan Availability and Cost

Several factors can influence the availability and cost of home insurance installment plans:

- Insurer’s Policies: Different insurance providers have varying policies regarding installment plans. Some may offer them as a standard option, while others might have specific requirements or limitations.

- Policy Coverage and Value: The coverage amount and value of the insured property can affect the cost of the premium and the availability of installment options.

- Credit History: As mentioned earlier, a homeowner’s credit score can impact their eligibility for installment plans and the associated interest rates.

- Payment Frequency: The frequency of installments chosen (monthly, quarterly, or semi-annual) can influence the total cost, with more frequent payments potentially leading to higher administrative charges.

FAQs Regarding Home Insurance Installment Plans

1. How do I qualify for a home insurance installment plan?

Qualification criteria for installment plans vary by insurer. However, common factors include:

- Creditworthiness: A good credit history generally improves eligibility and reduces interest charges.

- Policy Type and Value: Certain policies or property values may have specific requirements or limitations.

- Payment History: Consistent payment history with the insurer can enhance your standing for installment options.

2. What are the typical interest rates for installment plans?

Interest rates for home insurance installment plans vary depending on the insurer, credit score, and policy details. Some providers may offer interest-free plans, while others charge a small percentage. It is crucial to compare rates and terms from different insurers.

3. Are there any penalties for late payments?

Yes, most insurers impose late payment fees for missed installment payments. These fees can significantly impact the overall cost of the insurance policy. It is vital to establish a payment reminder system and prioritize timely payments to avoid these penalties.

4. Can I switch payment methods later?

Depending on the insurer’s policies, you may be able to switch from an installment plan to a lump sum payment or vice versa. However, certain restrictions or fees might apply. It is advisable to contact your insurer to discuss the available options and potential costs.

5. What are the advantages of paying my premium in full upfront?

Paying the premium in full upfront typically avoids interest charges and ensures that your coverage is active without any payment delays. It also demonstrates financial stability and may even qualify you for discounts with some insurers.

Tips for Choosing the Right Home Insurance Installment Plan

- Compare Offers: Obtain quotes from multiple insurers and compare their installment plan options, including interest rates, fees, and payment frequencies.

- Review Terms and Conditions: Carefully review the terms and conditions of each installment plan to understand the payment schedule, interest charges, late payment fees, and any other relevant details.

- Consider Your Financial Situation: Assess your financial circumstances and choose an installment plan that aligns with your budget and payment capabilities.

- Prioritize Timely Payments: Establish a system to remind yourself of payment deadlines and prioritize timely payments to avoid late fees and potential coverage disruptions.

- Communicate with Your Insurer: If you encounter any challenges or require adjustments to your installment plan, communicate openly and promptly with your insurer to explore potential solutions.

Conclusion

Home insurance installment plans provide a valuable financial tool for homeowners seeking to spread the cost of their premium over time. By offering affordability, improved cash flow management, and predictable payments, these plans make insurance coverage more accessible and manageable. However, it is essential to carefully consider the potential interest charges, late payment fees, and availability limitations associated with these plans. By comparing offers, reviewing terms and conditions, and prioritizing timely payments, homeowners can make informed decisions and leverage installment plans to secure the financial protection they need while maintaining financial stability.

:max_bytes(150000):strip_icc()/homeowners-insurance-guide_final-88e7d3469dcc4920977498f08564b234.png)

Closure

Thus, we hope this article has provided valuable insights into Navigating Home Insurance: Understanding Payment Plans and Their Benefits. We appreciate your attention to our article. See you in our next article!